Texas Border Business

Collections agencies also get involved

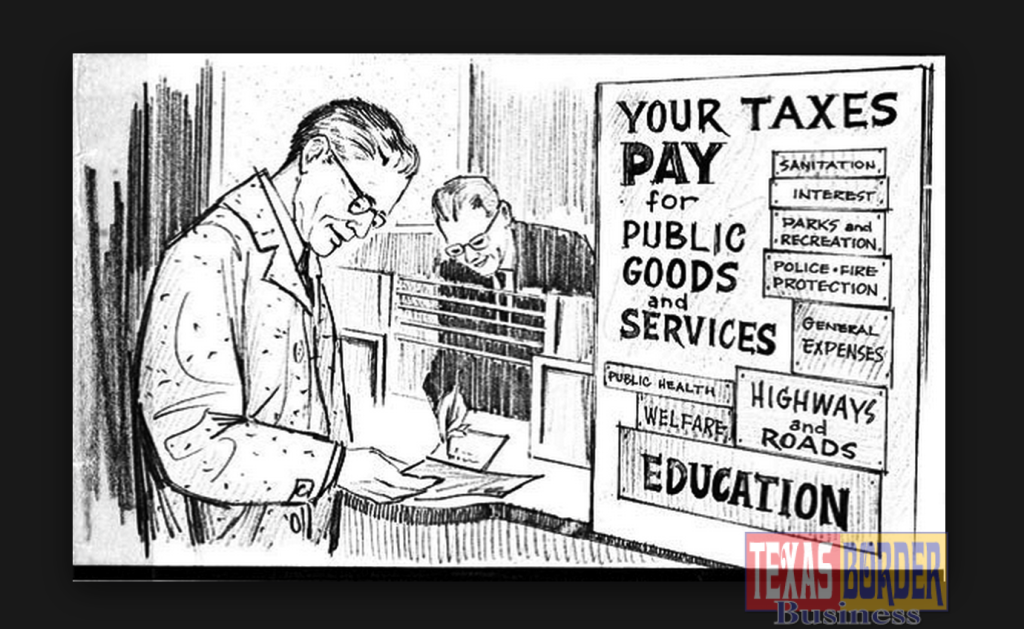

The April 15 federal income tax deadline might be fading in the rearview, but a property tax deadline is bearing down on Texas homeowners with the threat of huge financial penalties. Come July 1, Texans who haven’t paid their property tax bills face total costs up to 42 percent larger than when they received their annual property tax bill in late 2014.

By now, those property tax bills have already grown about 15 percent since February. If the original tax bill on your home or business was $5,000, typical penalties levied by the taxing entities would balloon that bill by 15 percent to $5,750.

But it gets a lot worse. Left unpaid by July 1, that same $5,000 tax bill suddenly becomes about $7,080. That includes almost 42 percent tacked on in county penalties, interest and collections fees added by the law firms most counties use when tax bills become six months delinquent.

“The skyrocketing costs are scary enough, but after six months of delinquency, you’re probably also facing a pretty intimidating law firm that is handling collections for the county,” said Jack Nelson, President and CEO of Propel Financial Services. “Those lawyers are going to play hard ball until they and the taxing entities get their money. Or worse, they may eventually foreclose on your home or business.”

It is critical, Nelson said, for property owners to do everything possible to pay the bill before July 1. “They might be able to borrow the money from family, sell off a boat, or do something else to raise the money, but they must get the bill paid to avoid the huge jump in penalties and to keep the law firms off their backs,” Nelson added.

Taxpayers should also call their local county tax office and ask about payment plan options. Dependent on the type of property, most counties offer a payment plan, and it can offer some relief by giving the property owner more time to pay the bill. The counties want to help people avoid losing their homes. But interest will still accrue and the county payment plans are limited in their flexibility.

Another option is a tax lien transfer. Propel and other tax lien transfer companies can pay the county’s tax bill for the taxpayer and work out a payment plan of up to 10 years with an interest rate usually in the 10-12 percent range.

About 15,000 Texans annually use a tax lien transfer to pay the taxes on their homes or businesses.

Nelson encourages property owners to look for a well-known and financially stable property tax financing company that has been around for at least five years and will provide you with a reasonable interest rate (often below credit card rates or the county’s interest rate). They will coach you through the process until you are back on your feet financially and help you avoid additional expenses due to unpaid property taxes.